For traders buying reliable way to identify potential turning points in the markets, the pivot points indicator mt4 is an invaluable tool. This indicator can be used with the favorite MetaTrader 4 (MT4) trading platform and provides traders having an easy-to-use graphical representation of potential support and resistance levels. In this article, we'll explain what pivot points are and how you can use them to increase your trading success.

What Are Pivot Points?

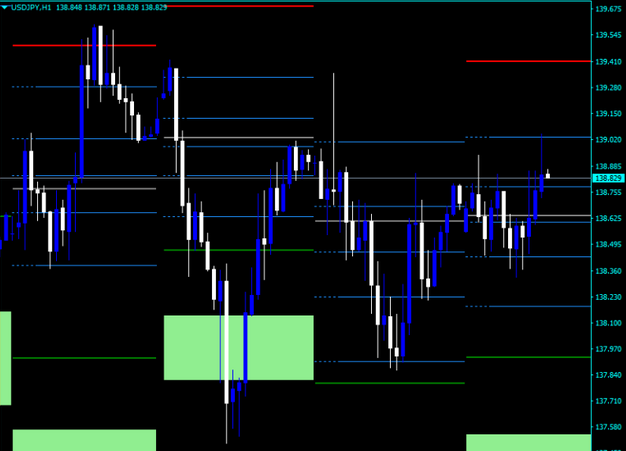

Pivot points are technical indicators which are used by traders to identify potential support and resistance levels in a market. They're calculated based on the previous day's high, low, and close prices. When plotted on an information, they form horizontal lines at different levels which mark entry and exit points for various trades. The pivot point itself is calculated by taking the average of three prices plus two additional levels above (resistance 1 & 2) and two below (support 1 & 2). These levels give traders a concept of where price action might pause or reverse direction.

Just how to Use Pivot Points in MT4

The Pivot Point indicator in MT4 is a good way to quickly view these important price zones without having to manually calculate them each day. To gain access to this indicator you will need to start the “Insert” menu located towards the top of your chart window. From there select “Indicators” followed by “Custom” then select “Pivot Points” from the listing of available indicators. Once you have done this you could have a fresh indicator put into your chart which will highlight all five pivot point levels along with their respective colors for quick identification.

When using this indicator it is essential to remember these lines act as potential support/resistance areas rather than exact entry/exit points like some other indicators might provide. As such, you may use other technical analysis tools such as trend lines or moving averages for confirmation before entering any trades based from your pivot point analysis. Additionally, it is very important to consider these levels may change as time passes so it is wise to test them daily to be able to stay ahead of any major price movements that can occur during volatile market conditions or when unexpected news breaks out affecting certain markets or currencies pairs traded on MT4 platforms like Forex or CFDs.

Conclusion: In conclusion, pivot point indicators is definitely an invaluable tool for traders trying to find reliable ways to identify potential support and resistance levels within their charts without having to do manual calculations each day. By accessing this powerful indicator throughout your MT4 platform, you can begin implementing pivot point strategies into your own trading plan today! However, bear in mind that although pivot points can behave as useful guides during times of uncertainty or volatility; they should never be utilized alone as exact entry/exit points since market conditions are usually changing quickly meaning that even these powerful indicators may not always predict future price movements accurately each time! All the best!